SPARCK’s Product Design capability, in conjunction with a BJSS delivery team, helped a leading international bank transform its traditional branch-based customer on-boarding experience into fully self-service digital journeys, as part of a global digital transformation initiative.

Objective

Challenger banks and innovative Fintech startups have long been reshaping customer expectations in the banking industry in a multitude of ways. In particular, they’ve opened our eyes to how easy it can be to open a new account, in just seconds, in the convenience of our own homes and without having speak to anyone at all, due to the standardisation of straight through processing. Naturally, there has been a desire amongst incumbents to seek parity with these new players in the retail banking sector and this was a priority for our client.

At the time of starting the project, conversion rates for the current account opening solution offered by our client were under 5% and required all applicants to complete the journey in a branch. The process was further complicated by an onerous set of back-office activities, a dated tech stack and an inconsistent approach to customer experience across numerous countries. This all resulted in a pretty poor customer experience.

Approach

Overview

Our role as part of the ‘Originations and Utilities’ programme was to ensure:

- A measurable improvement in the customer experience for global current account applicants.

- The delivery of high quality account opening services that offered clear value to customers.

- A positive cultural shift within the internal design and delivery capabilities.

To make this happen, we established a cross-functional delivery team which included product designers, developers, back-end integration experts, Enterprise Agile delivery leads, and software testers. We embedded a blend of SPARCK’s Design Thinking methodology with BJSS‘ award-winning Enterprise Agile approach which contributed to reducing operational costs, while also increasing efficiency for the delivery teams.

From the outset, we placed positive customer outcomes as the primary indicator of success for the project, instead of process or business outcomes, which allowed us to make sure that every decision made had customers and users at the heart of it.

Journey mapping and prototyping to minimise risk

Designing journeys for financial services presents some unique challenges which we needed to overcome. Our initial research revealed to us that users can be intimidated by the amount of detail required for a successful application. We hypothesised that, as a result of this, users are more likely to abandon the on-boarding journey prematurely.

Our initial research revealed to us that users can be intimidated by the amount of detail required for a successful application.

To counter this, we began by mapping out an ideal user journey and used this to inform the structure of an Axure prototype. Our aim was to provide evidence of users struggling to complete the journey, given the amount of data required from them. This proved invaluable in motivating our clients internal Customer Due Diligence team to review the amount of questions they were expecting users to complete.

We also prototyped and tested a ‘progressive reveal pattern’ which was designed to only reveal certain questions to a user, based on how they answered the preceding questions, thereby reducing the cognitive load placed on each applicant. We also found that by breaking up the question sets into distinct thematic sections (such as, personal, residential, employment, financial and account usage details) also reduced cognitive load for users. This also had a measurably calming effect on users who were then far more inclined to complete the application process.

Designing the bank of tomorrow

Soon after our initial research, we quickly pivoted to designing and developing live alpha versions of the service. We used a ‘prototyping sprints’ focused on identifying and addressing technical, integration, usability and accessibility issues well in advance of the final product launch. This also gave us the ability to validate our ideal journey with users at a far higher level of fidelity, and across multiple regions.

We used a ‘prototyping sprints’ focused on identifying and addressing technical, integration, usability and accessibility issues well in advance of the final product launch.

An important consideration for us during the Alpha phase was how the regulatory, legislative, technical and behavioural factors that govern the retail banking industry can be heavily nuanced from one region to another. For example, the requirement to validate a customer in the UK is not nearly as stringent as it is in Hong Kong. To address this, we began to investigate technology solutions that would allow us to perform realtime identity verification using device hardware – a first for the bank.

We also began work on a service that would allow customers to perform a soft-check on their credit history to reveal what sort of account they would be best suited for, prior to undergoing a full account application.

Outcome

Where are we now?

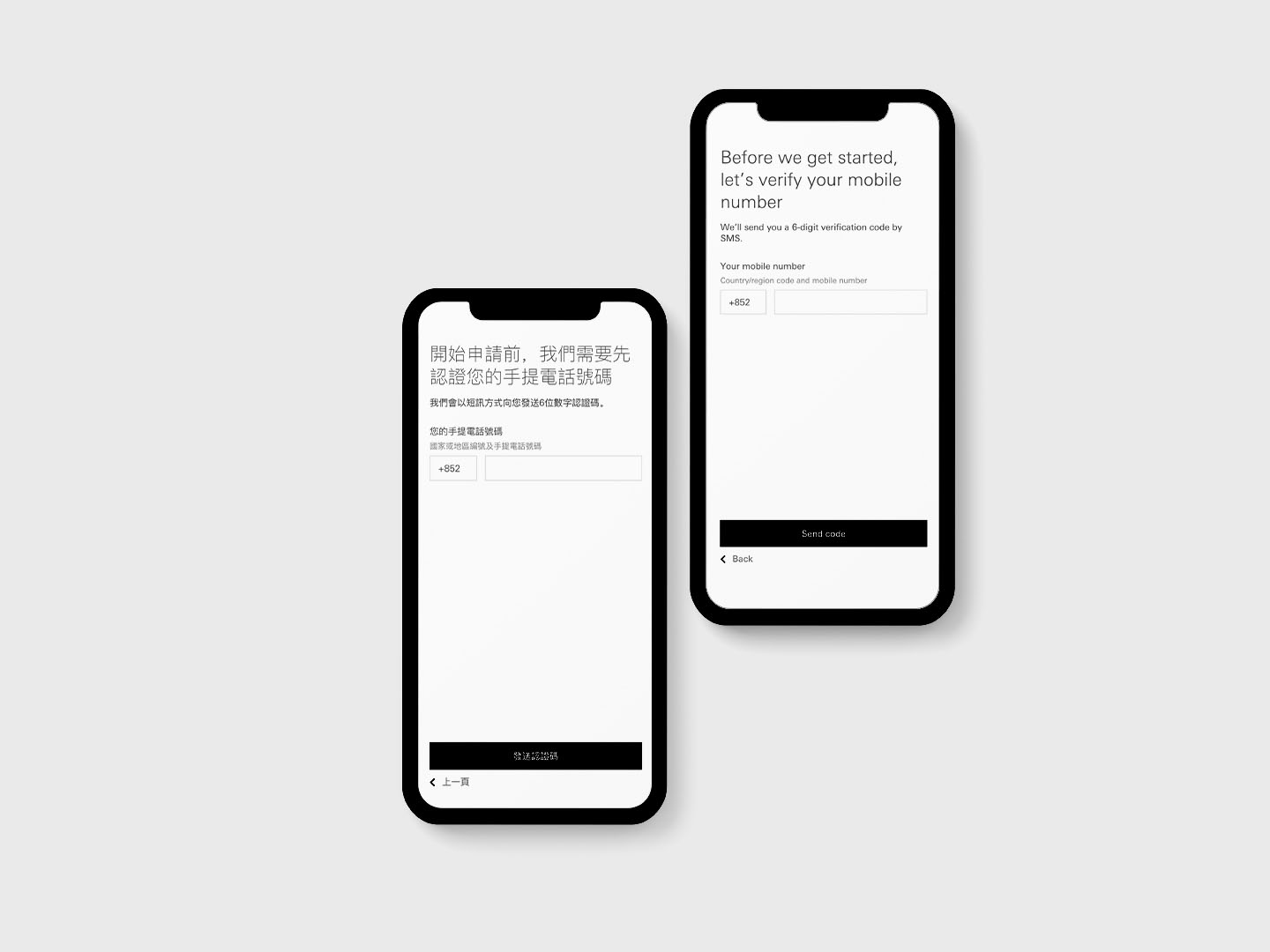

To date, SPARCK and BJSS have released multi-lingual, straight-through-processing, self-service account opening journeys in the UK, Hong Kong, Canada and Mexico.

The Hong Kong service is the first to offer customers in the region the opportunity to open an account, without the need to visit a branch.

As well as delivering world class customer on-boarding services, we have also been instrumental in changing how customer-centric design is viewed within the organisation. Where previously success was measured in terms of number of features delivered, there is now an expectation that value is determined by usability based metrics, such as reducing the time taken to complete a journey, increasing the number of successful applications and decreasing the number of abandoned journeys.

Notable achievements

- Increased conversion rates for new current account customers in the UK from 5% to upwards of 45% since launch .

- Reduced time taken to complete the application service from 15-20 minutes previously to 7-9 minutes today.

- Designed, prototyped and tested a soft credit check journey that will allow users to test their suitability for an account without leaving a permanent footprint on their credit history.

- Delivered a journey that integrates a One Time Passcode via SMS and video based customer identity verification service for the Hong Kong market.

- Delivered a scaleable design system that allows for new journeys to be rolled out quickly and consistently.

- Ensured customer focused design is embedded at every step of the delivery process.